by Numera | Apr 2, 2025 | Bookkeeping and Accounting, Business Management

Bookkeeper vs accountant: when it comes to managing your business finances, the terms bookkeeper and accountant are often used interchangeably. However, they perform very different roles. Understanding the difference between accounting and bookkeeping is crucial for business owners who want to stay compliant, make informed decisions, and plan for sustainable growth.

At Numera, we help Brisbane-based businesses take control of their finances through expert bookkeeping support. In this article, we’ll break down the key differences between bookkeepers and accountants, explain what a bookkeeper does, and help you decide which professional is right for your business.

What Is a Bookkeeper?

A bookkeeper is responsible for recording and organising your day-to-day financial transactions. They keep your business’s financial records accurate and up to date, which is essential for tracking cash flow, managing expenses, and preparing for tax time.

Typical Bookkeeping Tasks Include:

Bookkeepers are hands-on with the numbers, working closely with business owners to ensure everything runs smoothly behind the scenes.

What Is an Accountant?

An accountant uses the financial data prepared by a bookkeeper to provide higher-level financial analysis and strategic advice. Accountants help businesses interpret their numbers, ensure compliance with tax laws, and make informed decisions for long-term success.

Key Accounting Responsibilities Include:

-

Preparing and lodging tax returns

-

Providing financial and business advice

-

Developing budgets and forecasts

-

Managing company structure and compliance

-

Conducting audits

-

Analysing profitability and performance

While accountants can provide bookkeeping services, they typically focus on the bigger financial picture.

Bookkeeper vs Accountant: Key Differences

So, what is the real difference between accounting and bookkeeping? In simple terms:

Bookkeepers are essential for maintaining accurate records and staying on top of day-to-day tasks, while accountants are more involved in compliance, reporting, and strategic planning.

Do You Need a Bookkeeper, an Accountant – or Both?

Most small to medium-sized businesses in Brisbane can benefit from working with both a bookkeeper and an accountant. A bookkeeper ensures your financial data is accurate and timely, making it easier for your accountant to provide valuable insights and support.

At Numera, our qualified bookkeepers collaborate with your accountant to ensure your books are in excellent shape and your business stays on the right track.

Why Bookkeeping Is Essential for Your Business

Accurate bookkeeping isn’t just about compliance – it gives you clarity and confidence in your business decisions. Here’s why smart Brisbane business owners choose professional bookkeeping:

-

Stay organised: Avoid the stress of missing receipts or scrambling at tax time

-

Save time: Focus on running your business, not balancing the books

-

Improve cash flow: Track what’s coming in and going out in real time

-

Support growth: Make informed decisions with accurate financial reports

-

Ensure compliance: Stay on top of ATO deadlines and reporting requirements

Choose Numera: Your Brisbane Bookkeeping Experts

If you’re wondering whether you need a bookkeeper or accountant, start by making sure your books are in order. At Numera, we provide reliable, efficient, and professional bookkeeping services tailored to Brisbane businesses.

We’re more than just number crunchers – we’re your financial support team. Whether you’re a start-up, sole trader or growing business, we’ll keep your finances clear, compliant, and under control.

FAQs

What is a bookkeeper?

A bookkeeper is a financial professional who records and manages your business’s daily financial transactions. They help keep your financial records accurate, up to date, and compliant with ATO requirements.

What is the difference between accounting and bookkeeping?

Bookkeeping involves recording and organising financial data, while accounting involves interpreting that data to provide strategic financial advice, prepare tax returns, and support business planning.

Should I hire a bookkeeper or an accountant?

Both professionals play important roles. If you need help managing your day-to-day finances, a bookkeeper is essential. For tax planning and financial advice, you’ll want to work with an accountant as well.

At Numera Bookkeeping Services, we provide more than most traditional bookkeepers. With significant experience across a wide range of industry sectors, we are able to support you with all the standard bookkeeping services as well as BAS preparation and lodgment, payroll outsourcing services, advice on the selection of accounting packages and software training. If you need the services of a local accountant, our referral partners, MGI South Queensland are on hand to offer more detailed accounting advice. Work with the Brisbane bookkeepers you can trust. Give us a call today on 07 3002 4880 or email [email protected] to find out how we can help your business.

by Numera | Oct 7, 2023 | Business Management

by gpm | Mar 2, 2021 | Business Management

“I can’t work any harder and I don’t know how my business is travelling.”

“I don’t feel like I understand my business.”

“I made $300k last year, was it a good year?”

“Numbers give me headaches”.

“My accountant tells me I have to $50k in tax as I made a profit last year. But WHERE IS THE CASH?”

These are some of the most common refrains we hear from clients. These are all heart-felt cries for help for no-nonsense, simple ways to understand their businesses, how it operates, its financial performance and its ability to provide for a lifestyle.

How To Run Your Business More Efficiently

After having worked with numerous businesses from many industries, we found that the following process works the best in helping our clients:

- Having regular meetings with them to help to spend time working on their business, not just in it;

- Providing them with easy-to-understand and yet at the same time, sophisticated reporting on the key metrics for the business; and

- Providing them with a sounding board to make decisions.

The centrepiece in our process is our ability to provide easy-to-understand reports focusing on the key metrics for the business. These provide our clients with the “hard numbers” from which they can come up with options and make decisions.

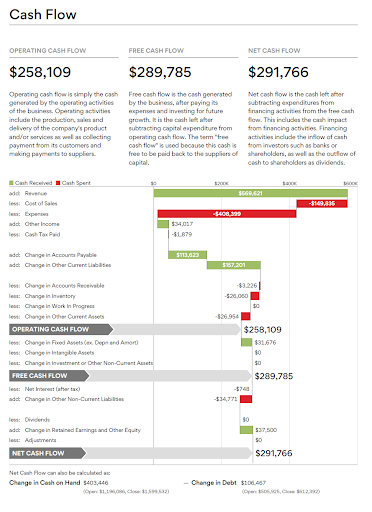

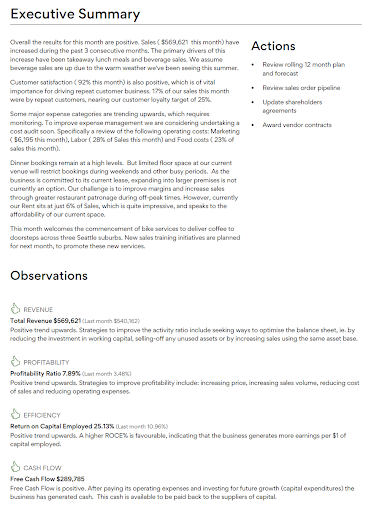

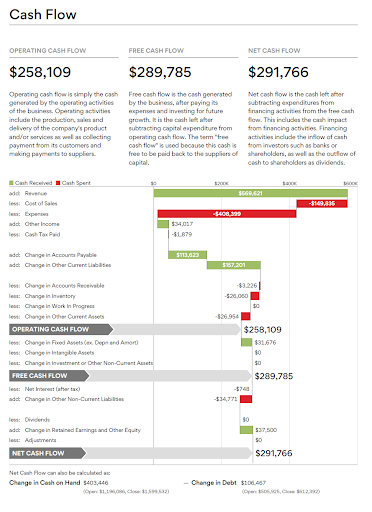

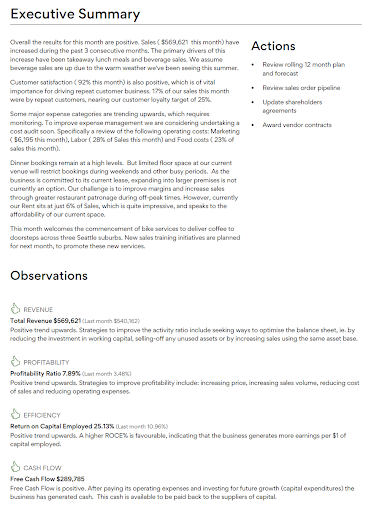

For example, it is no secret that the hospitality industry has had a tough time lately due to the lockdowns. It is now even more critical for the owners of restaurants and cafes to keep a close eye on their numbers. Here are some of the screenshots from reports prepared for a restaurant client. Accounting and Management reports like these have proven to be extremely helpful in helping the client in making the right decisions to thrive and not just survive in the current downtown.

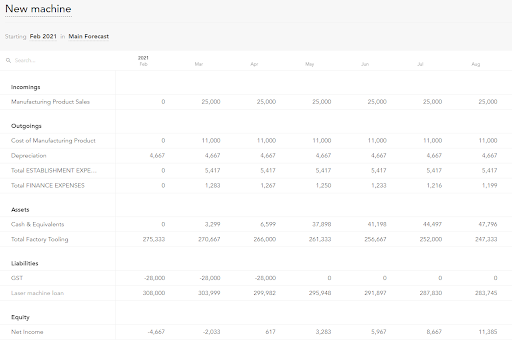

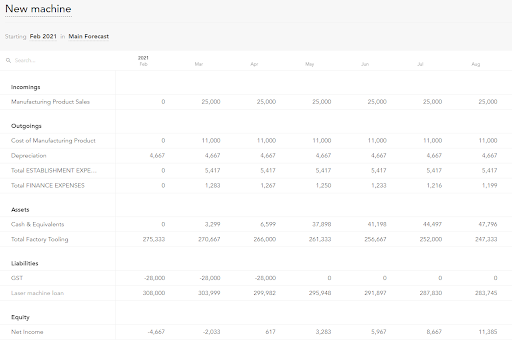

Here is another example from a what-if analysis we did for manufacturing client, whose business received a bump in sales as they supplied products which were in high demand due to the lockdowns. In this case, they asked us if they can afford to invest in a particular piece of machinery to keep up with the increased demand, and we were able to answer their question on the spot with an instant profit and cash forecast which our purpose-built software is capable of.

Numera have helped many businesses to increase their profitability and manage their businesses more efficiently. If you would like to talk to one of our senior team about how we can help you understand and grow your business and improve its profitability, give us a call on 07 3002 4800 today or fill in your details below and one of the team will be in touch.

by gpm | Mar 2, 2021 | Business Management

Shrinkage in the retail sector has a major impact on the profitability of supermarkets and other stores. Shrinkage is the result of theft by customers and staff, and is also caused by damage to goods as a result of poor ordering and handling practices. It can be equal to three per cent of sales at some independent supermarkets. The shrinkage problem tends to be worse in smaller stores with an average shrinkage factor of around five percent. If retailers want to improve profitability they first need to understand shrinkage.

A recent case study revealed a supermarket business turning over 10 million dollars per year while poor shrinkage control contributed to losses of 10 thousand dollars per week off its bottom line. It seems the smaller a supermarket is, the higher the shrinkage problem. As independent supermarkets increase their turnover, the shrinkage problem reduces to an average of around 1.75 percent. Better quality systems, and better management of the factors that drive shrinkage, contribute to the lower figure in larger supermarkets. Best practice operations are achieving shrinkage levels of less that 0.5 percent.

In reality, most supermarket operators do not know the true cost of shrinkage. Often this is the difference between success and failure of the business particularly when profit margins are so tight. An improvement in shrinkage management of just one per cent of sales can improve profitability by thirty-three percent. This type of saving can enable retailers to channel their resources into areas which will make a positive impact upon their cash flow.

Identifying Shrinkage

Shrinkage can be defined as the loss in margin due to poor stock management procedures, reporting practices and internal controls. It is measured by comparing the gross margin from the Point of Sale (POS) Report to the financial accounts or internal stock management reports.

Some of the factors that contribute to shrinkage include theft by customers and staff in the supermarket, inconsistent pricing practices, excessive and uncontrolled discounting, absence or infrequent stock taking, as well as damage to goods as a result of poor handling and ordering practices. For managers and owners, shrinkage is a very attractive area to address as the benefits flow straight to the bottom line. We advocate benchmarking the store to identify the gravity of the issue.

Some of the best practice operators have achieved low shrinkage levels by implementing stock management systems, which are compatible to existing POS systems, allowing for automatic re-ordering, regular rolling stock-takes on high-risk items, and stock management procedures. These systems are supported by staff training and job descriptions and assigning responsibility to selected staff, thus delivering tangible benefits to the supermarket owner.

Just some of these benefits include improved cash flow from reduced stock levels, as a result of ordering of stock consistent with sales demand, reduced theft by making high risk items more visible to staff, and providing an early detection of pilferage through instant stock management reporting.

This type of improvement enables the retailer to then direct their resources into other areas, such as improving their supermarket layout and design. Shrinkage efficient supermarkets are most likely to survive and thrive in a competitive market. To improve profitability allows retailers access to funding for supermarket refurbishments, which is an essential part of competing for market share against national chains.

Shrinkage Reduction Planning

Financial benefits show as soon as a supermarket addresses its shrinkage problem. The best way to begin this process is for the retailer to talk to a professional adviser, or seek advice from industry specialists to develop an action plan to implement better operational practices.

Most retailers are time-poor and work long hours so the most effective way to develop a shrinkage plan is to identify your immediate goals, determine what resources are required (money, people, and time) and allocate tasks to responsible persons. One of the biggest shrinkage issues is that supermarket owners do not compare their management account gross profit (GP) percentage with what comes out from their POS system. This is a big mistake. We found most retailers were unable to produce accurate management accounts on a timely basis and most often conduct stock-takes once a year for tax purposes.

Shrinkage loss really hits home when retailers compare their GP in the financial accounts provided by their Accountant to POS reports. The key is to develop a stock management system that allows for timely and accurate management reporting. Our industry manager recently saw supermarket figures showing a nine percent difference between the POS GP percentage and accounting GP percentage.

For example, regular weekly stock-takes of high wastage and theft items (e.g. meat and fruit/vegetables and tobacco) and cyclic stock-takes on other items will allow for effective monitoring of GP variances.

Adopting a standardised chart of account and journals will improve management reporting of shrinkage as scanning systems ignore the issue. Some supermarket chains have front-end systems that record all customer returns and place the reason for the return and reports at the back office each day and for the week. Further ‘reduced to clear items’ are also all managed via the front end.

Some chains also ensure its cleaners to place floor waste into a separate bin. This separate bin is then checked to see what products the cleaners have swept up and if these products can be reclaimed. It is important that staff take the time to monitor stock, even if it does mean checking the dairy fridge more frequently. You can use technology to keep track of perishables within the supermarket.

If you’re struggling to get clarity on your gross profit margins and want to improve profitability, talk to the team at Numera about our Virtual CFO and Accounting Reporting services.

Disclaimer: this information is of a general nature and should not be viewed as representing financial advice. Users of this information are encouraged to seek further advice if they are unclear as to the meaning of anything contained in this article. Numera accepts no responsibility for any loss suffered as a result of any party using or relying on this article.

by Numera | Sep 4, 2019 | Bookkeeping and Accounting, Business Management, Financial Literacy

Whether you’re an established business or you’re just setting up your first small business, developing good bookkeeping habits will stand you in good stead when it comes to understanding how your business is performing. Keeping track of your income and business expenses, regular invoicing and management of your payroll are all part of the job. So what processes should small business owners put in place to keep things in good order. Here are 5 top bookkeeping tips for small businesses:

1. Choose The Right Accounting and Bookkeeping Software

Investing in an accounting software program can make a world of difference for small businesses trying to manage their bookkeeping. It’s worth having a good look at the various options available. Among the most popular packages are MYOB, Xero, Reckon and Quickbooks but there are many more out there.

Many small business owners now choose cloud or online accounting packages as they enable you to work on your data from anywhere that you have internet access. It also means that your accountant and bookkeeper can work on files remotely and simultaneously.

It’s also worth noting that some accounting and bookkeeping firms specialise in one or two packages. So if you are looking for advice on which accounting software will best suit your needs, it’s best to look for advisors who work with all packages. The team at Numera have experience with all the major packages and can offer independent bookkeeping tips and advice about which software will best suit your needs.

And it’s worth remembering that you can claim the monthly software subscription costs as a business expense.

2. Keep Business And Personal Banking Separate

If you are a new small business owner, one of the top bookkeeping tips is to set up business bank accounts straight away. Make sure that all business transactions are processed through these accounts so that you can easily see day to day expenses and income.

Once your business is up and running it can be much harder to untangle your business finances and get a clear view of your financial data and cash flow in your bookkeeping and accounts.

If you or your bookkeeper are spending time processing personal transactions it’s a waste of time and resources. If your personal finances are mixed up in the business financial data, they will have to be entered into the bookkeeping software and coded to drawings. If you are paying a bookkeeper to do this, it can add unnecessary costs to your bill.

It’s also a good idea to set up a business savings account to set aside money from your business earnings to pay your tax obligations. You may also want to consider applying for a business credit card.

3. Understand Your Tax Obligations

Taking some time to understand your tax obligations may not sound that exciting but it’s definitely one of our top bookkeeping tips for small businesses. You would be amazed at how many small business owners, many of whom have been in business for a long time, don’t fully understand their business tax requirements and how they differ to individual income tax.

Make time to understand the basics such as when your small business is required to register for GST and what your BAS reporting requirements are. That way you can feel confident that you staying compliant with ATO rules and guidelines.

And it’s not only about understanding how much tax you may be liable for. Keeping accurate records of your spending and business expenses can also ensure that you get any tax deductions that you may be entitled to.

4. Learn The Most Valuable Bookkeeping Reports

Most good bookkeeping and accounting software packages allow you to easily generate a wide range of reports to help you understand how your business is performing. However, they are only useful if you actually understand what they’re telling you.

One of our top bookkeeping tips for small businesses is to invest some time in learning which bookkeeping reports are the most valuable for your business.

The accounts receivable report and balance sheet are among the most important accounting reports for your small business. Start by spending some time getting familiar with these and build your financial literacy from there.

5. Know When To Outsource To Professional Bookkeepers

As a small business owner, you have a million and one things to do every day. Making enough time to stay on top of your bookkeeping might be just a step too far, particularly as your business starts to grow. Knowing when to engage the services of a professional is another of our top bookkeeping tips for small businesses.

A good bookkeeper can help your business in so many ways. Keeping accurate financial records will make life much easier for your business when it comes to remaining compliant with ATO requirements, such as BAS reporting, as well as helping you get meaningful advice from your accountant.

At Numera Bookkeeping Services, we provide more than most traditional bookkeepers. With significant experience across a wide range of industry sectors, we are able to support you with all the standard bookkeeping services as well as BAS preparation and lodgment, accounting software support for packages including Xero, MYOB, Quickbooks and Reckon as well as payroll outsourcing and accounting support services.

Work with the Brisbane bookkeepers you can trust. Give us a call today on 07 3002 4880 or email [email protected] to find out how we can help your business.

by Numera | Aug 6, 2019 | Business Management, Financial Literacy

We often get asked about the BAS requirements for small business and in particular which businesses are eligible for Simpler BAS reporting. If you are a small business owner and you are registered for GST, you will be aware that you are required to lodge a Business Activity Statement (BAS) every month or quarter. As part of the Federal Government’s initiatives to reduce red tape for SME’s, they introduced simpler BAS reporting in 2017. If you’ve only recently started your business you may not have realised that prior to July 2017 the reporting requirements for businesses with a turnover of less than $10 million, was a whole lot more complicated than it currently is. So just what are the BAS requirements for small business and what information do you have to report? Let’s start with the basics…

What Is A BAS?

BAS stands Business Activity Statement and is a statement you submit to the Australian Taxation Office (ATO) to summarise how much revenue your business has generated along with some key expenditure figures. It is used to report on and pay several different types of taxes including Goods and Services Tax (GST), Pay As You Go (PAYG) instalments, PAYG withholding tax and any other tax obligations or credits that you have as a business. The ATO uses the information you submit in your BAS to work out your GST bill or refund. So effectively your BAS determines how your tax liability is assessed.

Who Has To Lodge A Business Activity Statement?

If you’re registered for GST then you will have to complete a Business Activity Statement. GST registration is required if your business has a projected annual turnover of more than $75,000. So while you may not need to be registered for GST as soon as you start up your business, if you are likely to reach this threshold, it’s probably wise to register for GST. You have 21 days to register once your business’ gross income (excluding GST of 10%) exceeds the $75,000 limit.

BAS Requirements For Small Business

If you are registered for GST and your turnover is less than $10 million per year, you’re now eligible to report your BAS using the Simpler BAS reporting format. However, if your turnover is more than $10 million you will have to complete the more detailed BAS statement.

Simpler BAS

With the Simpler BAS, you are only required to report:

- G1 Total Sales

- 1A GST on sales

- 1B GST on purchases

The following information is not required:

- G2 – Export sales

- G3 – GST-free sales

- G10 – Capital purchases

- G11 – Non-capital purchases

Your BAS must be lodged by the 21 st of each month if you pay monthly, or the 28th of October, February, April, and July if you pay quarterly. Most GST-registered businesses complete a Business Activity Statement every quarter but you will need to ask your bookkeeper to check with the ATO whether you need to do it more frequently.

It’s important to remember that you need to submit a BAS even if you did no business during that reporting period and if you are late lodging you might be charged a penalty by the ATO. You can lodge your BAS online, by post, by phone, or through your bookkeeper or accountant.

The simpler BAS requirements certainly help small businesses in terms of reducing the paperwork. However, it doesn’t change the requirement for good bookkeeping and record-keeping. Despite not having to report on as much data, you will still need this information for other reporting. Maintaining accurate, detailed records will help your accountant support you to grow your business, reduce your tax obligations and increase profitability.

As a registered BAS Agent, the team at Numera Bookkeeping help businesses to maintain detailed records and develop efficient processes to give your business the best chance of minimising their tax obligations and growing your profits. Our Brisbane bookkeepers help you to put in place back-end processes and monthly reporting that put you in the best possible position for an accountant or business advisor to get an accurate view of the business and be able to advise you without having to second guess your figures. Using a bookkeeper also means that you stay up to date with any changes in ATO reporting rules and expectations.

If your business needs support with BAS preparation and lodgement, don’t hesitate to give us a call on 07 3002 4880. The team at Numera has experience with all the major accounting software packages, including Xero BAS, MYOB, Quickbooks and Reckon. With significant experience across a wide range of industry sectors, we are able to support you with all the standard bookkeeping services as well as advising on the most appropriate accounting method for your business.