Shrinkage in the retail sector has a major impact on the profitability of supermarkets and other stores. Shrinkage is the result of theft by customers and staff, and is also caused by damage to goods as a result of poor ordering and handling practices. It can be equal to three per cent of sales at some independent supermarkets. The shrinkage problem tends to be worse in smaller stores with an average shrinkage factor of around five percent. If retailers want to improve profitability they first need to understand shrinkage.

A recent case study revealed a supermarket business turning over 10 million dollars per year while poor shrinkage control contributed to losses of 10 thousand dollars per week off its bottom line. It seems the smaller a supermarket is, the higher the shrinkage problem. As independent supermarkets increase their turnover, the shrinkage problem reduces to an average of around 1.75 percent. Better quality systems, and better management of the factors that drive shrinkage, contribute to the lower figure in larger supermarkets. Best practice operations are achieving shrinkage levels of less that 0.5 percent.

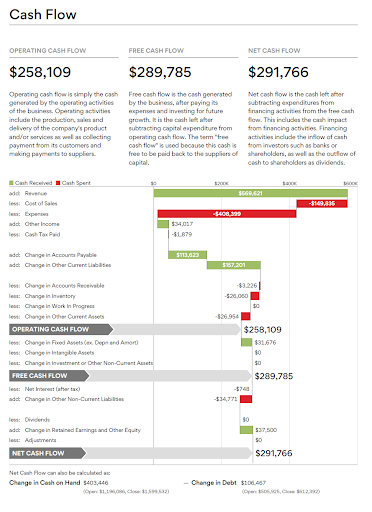

In reality, most supermarket operators do not know the true cost of shrinkage. Often this is the difference between success and failure of the business particularly when profit margins are so tight. An improvement in shrinkage management of just one per cent of sales can improve profitability by thirty-three percent. This type of saving can enable retailers to channel their resources into areas which will make a positive impact upon their cash flow.

Identifying Shrinkage

Shrinkage can be defined as the loss in margin due to poor stock management procedures, reporting practices and internal controls. It is measured by comparing the gross margin from the Point of Sale (POS) Report to the financial accounts or internal stock management reports.

Some of the factors that contribute to shrinkage include theft by customers and staff in the supermarket, inconsistent pricing practices, excessive and uncontrolled discounting, absence or infrequent stock taking, as well as damage to goods as a result of poor handling and ordering practices. For managers and owners, shrinkage is a very attractive area to address as the benefits flow straight to the bottom line. We advocate benchmarking the store to identify the gravity of the issue.

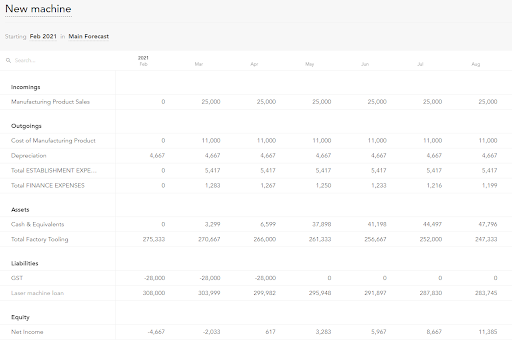

Some of the best practice operators have achieved low shrinkage levels by implementing stock management systems, which are compatible to existing POS systems, allowing for automatic re-ordering, regular rolling stock-takes on high-risk items, and stock management procedures. These systems are supported by staff training and job descriptions and assigning responsibility to selected staff, thus delivering tangible benefits to the supermarket owner.

Just some of these benefits include improved cash flow from reduced stock levels, as a result of ordering of stock consistent with sales demand, reduced theft by making high risk items more visible to staff, and providing an early detection of pilferage through instant stock management reporting.

This type of improvement enables the retailer to then direct their resources into other areas, such as improving their supermarket layout and design. Shrinkage efficient supermarkets are most likely to survive and thrive in a competitive market. To improve profitability allows retailers access to funding for supermarket refurbishments, which is an essential part of competing for market share against national chains.

Shrinkage Reduction Planning

Financial benefits show as soon as a supermarket addresses its shrinkage problem. The best way to begin this process is for the retailer to talk to a professional adviser, or seek advice from industry specialists to develop an action plan to implement better operational practices.

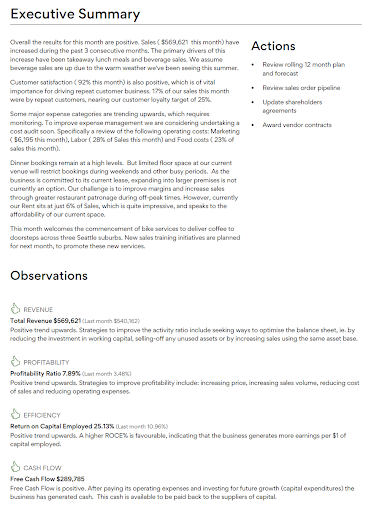

Most retailers are time-poor and work long hours so the most effective way to develop a shrinkage plan is to identify your immediate goals, determine what resources are required (money, people, and time) and allocate tasks to responsible persons. One of the biggest shrinkage issues is that supermarket owners do not compare their management account gross profit (GP) percentage with what comes out from their POS system. This is a big mistake. We found most retailers were unable to produce accurate management accounts on a timely basis and most often conduct stock-takes once a year for tax purposes.

Shrinkage loss really hits home when retailers compare their GP in the financial accounts provided by their Accountant to POS reports. The key is to develop a stock management system that allows for timely and accurate management reporting. Our industry manager recently saw supermarket figures showing a nine percent difference between the POS GP percentage and accounting GP percentage.

For example, regular weekly stock-takes of high wastage and theft items (e.g. meat and fruit/vegetables and tobacco) and cyclic stock-takes on other items will allow for effective monitoring of GP variances.

Adopting a standardised chart of account and journals will improve management reporting of shrinkage as scanning systems ignore the issue. Some supermarket chains have front-end systems that record all customer returns and place the reason for the return and reports at the back office each day and for the week. Further ‘reduced to clear items’ are also all managed via the front end.

Some chains also ensure its cleaners to place floor waste into a separate bin. This separate bin is then checked to see what products the cleaners have swept up and if these products can be reclaimed. It is important that staff take the time to monitor stock, even if it does mean checking the dairy fridge more frequently. You can use technology to keep track of perishables within the supermarket.

If you’re struggling to get clarity on your gross profit margins and want to improve profitability, talk to the team at Numera about our Virtual CFO and Accounting Reporting services.

Disclaimer: this information is of a general nature and should not be viewed as representing financial advice. Users of this information are encouraged to seek further advice if they are unclear as to the meaning of anything contained in this article. Numera accepts no responsibility for any loss suffered as a result of any party using or relying on this article.